Important Questions About Motor Vehicle Accidents

After a car accident, the victims of the accident often have many questions and very few answers. Here at Hixson & Brown, P.C., we want to help answer some of your earlier questions before you even come into our office. Every person’s case and situation will be different and will require specific consideration and advice, but here are some of the most common questions we hear.

What should I do after an auto accident?

The answer depends on your physical condition. Assuming that you are safe and not severely injured, the first step is to contact law enforcement and report the incident. Usually, this step is a legal requirement and will be helpful as the investigating officer will document basic information about the crash on an official form.

The emergency dispatch operator or the responding officer will likely ask if you are injured and need an ambulance. Even if you feel like you are not seriously hurt, it is a good idea to be examined by medical professionals. If you decline an ambulance, but later notice that you are in pain, it is wise to see a doctor as soon as possible.

You will also want to collect evidence and key information after the crash, including the following:

- The other driver’s name and insurance information

- Names and contact information of any witnesses

- Photographs and videos of the scene and vehicles involved in the accident, ideally taken the day of the crash

- Photographs of your injuries

What should I NOT do after an auto accident?

It is almost universal that you should not settle or resolve your bodily injury claim within the days and weeks following the crash. This is especially if you have not physically returned to your old self. Give yourself time to get treatment and understand the extent of your injuries.

Insurers will sometimes contact the victim of an auto crash and attempt to resolve the claim for what may seem like a lot of money. You should be very cautious before you quickly sign a settlement contract, often called a Release, and settle your claim. There is often no going back if your injuries later prove more troublesome than initially thought.

Another common mistake is for victims of auto accidents to downplay or ignore their injuries. People do not like going to see a doctor, and they may simply think things will improve without care. But if you suffered a serious injury, you can harm your case by downplaying or avoiding medical care.

For example, insurance companies will often attempt to take a recorded statement from you following a crash. If you are asked about your injuries and you respond by saying “I’m fine” when you are truly not fine, your response is likely to be used against you at a later date.

What types of damages can I claim?

When you are injured in an auto accident, there are two general types of claims you can file:

- Property

- Bodily injury

Insurance companies may handle and resolve these claims separately. They will often assign a different claims handler or “adjustor” for each category.

Property damage claims are generally straightforward. Compensation will depend on the extent of your vehicle’s damages. If the vehicle is totaled, an analysis of the vehicle’s market value before and after the crash will be necessary. There may be other factors to consider such as the loss caused by your inability to use the vehicle, or damage to any tangible items (e.g. child car seat, cell phone, etc).

Most people need assistance with the bodily injury claim. Damages for a bodily injury claim, also known as a personal injury claim, may extend further than you think.

Common items of compensation within the bodily injury claim category include:

- Past and future medical expenses

- Past and future pain and suffering

- Past and future lost use of full body and mind

- Past lost wages or time from a business

- Future loss of earning capacity

The ability to recover these damages will depend on the evidence and the severity of your injuries. It is also important to understand that certain family members may have claims for certain categories of damages depending on your injuries.

How will I pay for my medical bills after the accident?

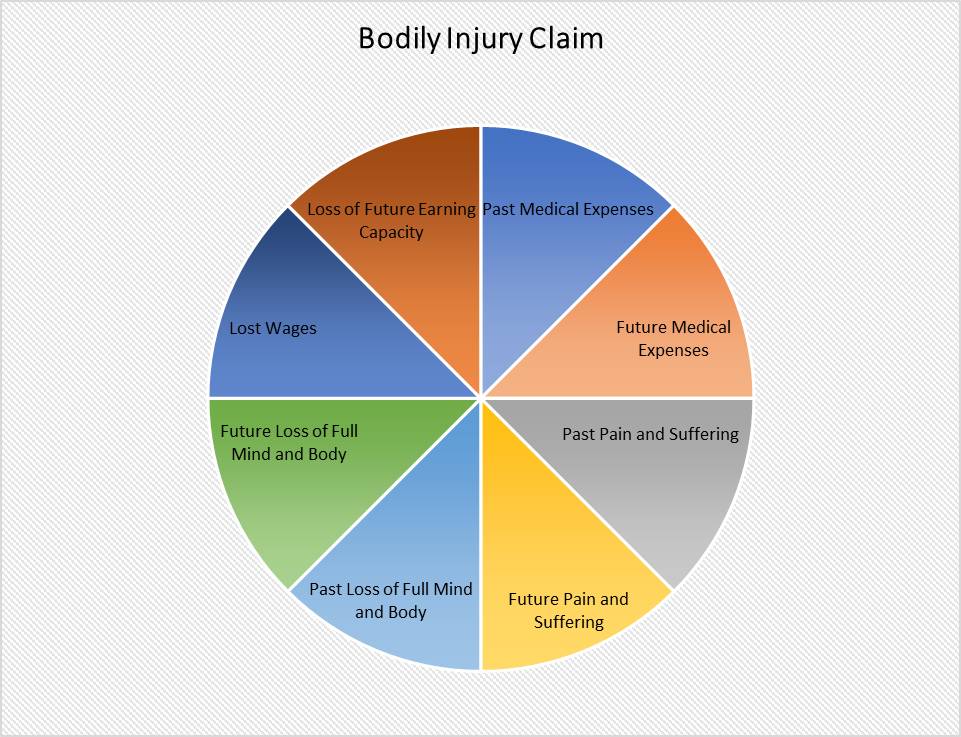

The first thing to understand is that the “at-fault” insurance company has the right to resolve the entirety your bodily injury claim at one time. The easiest way to think of this is to think of your bodily injury claim as a pie and the individual categories of damages as the slices:

The at-fault insurer does not have to compensate you for one slice (i.e. past medical expenses) until you have agreed on the value of the whole pie. This may seem unfair – and in many cases it is – but this is the system. It can be a hard situation if your doctors want paid, but you cannot settle the claim because you do not know the full extent of your other damages (i.e. pain and suffering).

If the at-fault insurance company does not immediately pay your medical bills, how should they be handled? The answer is complex and will depend on a multitude of factors, including:

- The extent of the injuries and the likely extent of needed treatment

- The nature of the treatment being received

- The type of facility providing the treatment (e.g. chiropractor vs. hospital)

- The type and amount of coverages available to you via your own auto insurance policy

- The nature of your personal health insurance plan, if any

- Your ability to cover out of pocket copays and deductibles

In most cases, it will make sense to have your medical provider submit the bills to your personal health insurance company. If you have co-pays, co-insurance and/or deductibles, you may need to cover these out-of-pocket until you resolve your bodily injury claim.

Many people leave the medical expenses caused by a crash unpaid assuming that the at-fault insurance company will ultimately pay them. This is a bad idea as there is no guarantee they will pay. At-fault carriers will attempt to find any defense that prevents their driver from being liable for your expenses. If they are successful, you will be on the hook for those medical bills.

What is medical payments coverage?

Medical payments coverage – often referred to as “med-pay” – is a specific type of coverage common to Iowa auto insurance policies. You may have med-pay coverage without realizing it. You may have some amount of money – often $1,000 or $5,000, but possibly more – available to you via your own auto policy to cover medical expenses incurred in a motor vehicle crash, regardless of who is at fault.

If you are in an auto accident and you are injured, you may be taken to the hospital emergency room. The hospital may submit the bill to your health insurance, but this might still leave you with a co-pay or deductible. You can take your co-pay or deductible bill (or receipt) and submit that to your auto carrier for payment or reimbursement under your med-pay coverage.

Warning: Some medical providers will often want to submit their bills to med-pay prior to submitting to your health insurance carrier. Depending on your situation, this could be detrimental. This is yet one more reason that contacting an attorney sooner rather than later can save you money in the long run.

What is the statute of limitations for personal injury claims?

Iowa has a two-year statute of limitations for personal injury lawsuits in most cases. If you fail to file your lawsuit with the court within this time frame, your lawsuit will be subject to dismissal. You should submit your bodily injury claim to the at-fault insurance carrier at some point after your injuries have either resolved or been deemed permanent by a medical professional, but also at some point before the two-year statute of limitations deadline.

It is important to note that the statute of limitations for minors or for individuals who are not deemed competent may be different. Contact our attorneys to find out what the statute of limitations is for your particular situation.

The other driver’s insurance company has accepted fault but the insurance company wants me to sign waivers allowing them to obtain my medical records. Should I sign their documents?

There is no single correct answer. Remember that you do not owe the other driver’s insurance company anything. You do not have to give the other driver’s insurance company a recorded statement, and you do not have to provide them documentation, including your medical records.

However, the other side of this coin is that the other driver’s insurance company does not have to resolve your claims if you do not provide information. Alternatively, they may simply offer you very little compensation. The best answer is to speak with an attorney that has your interests in mind before you start providing waivers of any type to the other driver’s insurance company. Remember, their interests are opposite of your interests.

How is fault determined in Iowa?

When you sue another individual seeking compensation for injuries and damages caused by a crash, a judge or jury – not the police, not the insurance companies – will be asked to assign fault between the drivers.

Sometimes it is clear who is responsible for a crash and that person will be assigned 100% of the fault. However, this is not always the case. Iowa law recognizes that more than one person may be at fault for a crash. In these situations, the judge or jury will have the authority to assign percentages as they see fit after hearing all the evidence.

If you are assigned more than 50% of the fault, then you will not be allowed to recover any damages. However, if you are assigned 50% or less of the fault, you will still be allowed to recover damages. Your recovery will simply be reduced by the percentage of fault assigned to you.

For example: A jury could find that you were damaged in the amount of $100,000, but that you were also 25% at fault for the crash. In this situation, you would only be allowed to recover $75,000. You will often hear this system described as a modified comparative fault system.

What should I do if an uninsured driver hits me?

If the other driver does not have insurance, your ability to recover fair compensation will likely depend on the financial status of the other driver and/or the coverages available to you via your own auto policy.

You may be able to pursue compensation directly from the uninsured driver via a lawsuit. However, if you obtain a fair monetary judgment at trial, it may still be a losing effort if you cannot collect actual money from the uninsured driver.

The best solution is to purchase sufficient uninsured coverage from your own auto carrier. If you are injured by an uninsured driver, but you have uninsured coverage, you will be able to make a claim against this coverage to obtain compensation for your injuries. (Note: Underinsured coverage is similar but applies when the at-fault driver does not have enough coverage). If the uninsured driver and your own policy are not viable sources of compensation, we can help you look for alternate sources of compensation.